PARTNER ECOSYSTEM

WHAT IS PEER-TO-PEER LENDING

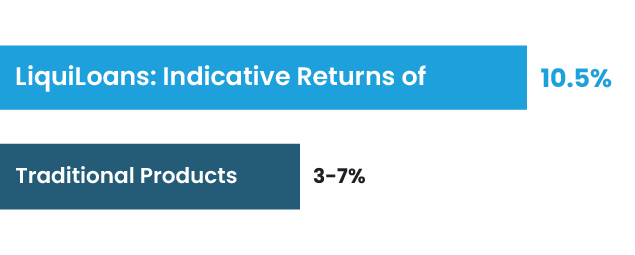

New Age Asset Class with

High Yielding Returns

Diversifying your wealth among creditworthy borrowers with

an average credit score of 700+ with complete safety and

transparency.

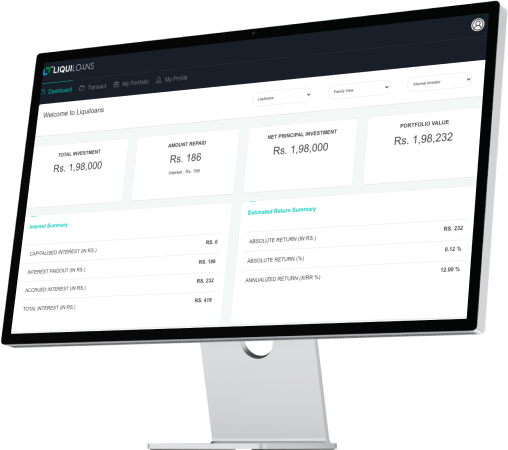

HOW DOES IT WORK

Lend. Earn. Repeat.

Create account & add funds

Please note that NDX P2P Private Limited ("LiquiLoans") has paused any new transactions since August 16, 2024.

Your funds are split across

200+ borrowers

All funds are managed through ICICI Bank & Trustee

Earn returns from borrower

repayments

WHY LIQUILOANS (NDX P2P Private Limited)

We diversify your funds in multiple loans to

Mitigate Risk and Get Safe Returns

High Diversification

Lender’s Funds spread across 150-200 borrowers.

Portfolio exposure per borrower limited to 0.5%.

Low Risk, Safe Returns

At 0% net NPA, 100% of lenders have made money at indicative returns without loss of capital

Robust Borrower Verification

Strong checks for KYC, Credit score and income

proof of borrowers

HOW TO LEND:

Lending is Easy

and Secure

Testimonials

Testimonials

Contact Us

Want to know more? Receive a

call back from us

* RBI does not guarantee any returns or principal for the amount invested on the P2P platform.

* It is an NBFC-P2P lending platform registered with the Reserve Bank. However, Reserve Bank does not accept any responsibility for the correctness of any of the statements or representations made or opinions expressed by the NBFC-P2P and does not provide any assurance for repayment of the loans lent on it.

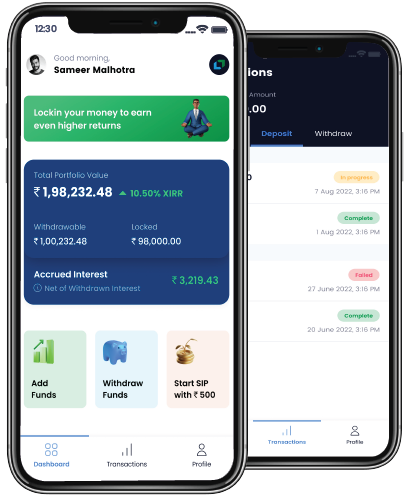

Download Our Investment App Now!

Download Our Investment App Now!